Free Sales Tax (GST) Calculator for NZ Businesses

Stop Guessing. Calculate GST in Seconds.

Whether you are quoting a new project or checking an invoice, getting the GST math wrong is a headache you don’t need.

I created this simple calculator to help NZ business owners quickly add or remove GST from any amount with 100% accuracy.

Simple Math, Serious Implications In New Zealand, GST (Goods and Services Tax) is 15%. It sounds simple, but calculating it backwards (removing GST from a total) or applying it to complex totals often leads to rounding errors that annoy your accountant—and the IRD.

Use this tool to:

- Add GST (Exclusive to Inclusive): You have a net price (e.g., $100) and need to know the total to bill the client ($115).

- Remove GST (Inclusive to Exclusive): You bought something for $115 and need to know the pre-tax cost for your books ($100).

- Check Invoices: Verify that a supplier has charged you the correct amount before you pay.

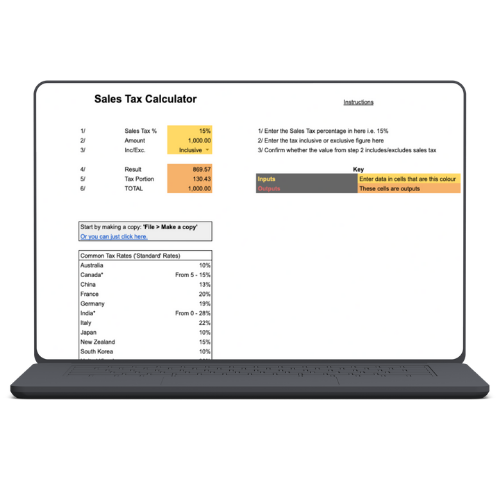

How to use it:

- Download: Click the button above to get the Google Sheet.

- Enter Amount: Type in your base figure.

- Toggle: Select whether you want to Add GST (15%) or Extract GST.

- Result: Get the exact figures for your Xero reconciliation immediately.

FAQs

- Q: What is the current GST rate in New Zealand? A: The current GST rate in New Zealand is 15%. This applies to most goods and services sold in NZ.

- Q: How do I calculate GST manually? A: To add GST, multiply your figure by 1.15. To remove GST from a total, divide the figure by 1.15. However, using a calculator ensures you don’t make rounding errors on the cents!

- Q: Can I use this for my GST return? A: This tool helps you calculate individual transaction amounts correctly. For your actual GST return filing, you should use accounting software like Xero or MYOB, or consult with a tax agent or accountant to ensure compliance.

The math is the easy part.

Whether you’re checking a price or sending a quote, getting the GST right is just compliance.

The real challenge is managing the cash. Do you have a system to ensure that 15% is actually there when the IRD comes knocking? Let’s build a forecast that keeps you safe.