Free Personal Debt Repayment Template (The Seedling Method)

Watch Your Debt Shrink and Your Confidence Grow.

Getting out of debt isn’t just a math problem; it’s a momentum problem.

I created “The Seedling Method” (based on the famous Debt Snowball strategy) to help you organize your personal finances, prioritize your debts, and see exactly when you will be debt-free.

I created this calculator to help you see beyond the “interest rate” and understand the real repayment numbers.

From Overwhelmed to Organized When you have multiple debts—credit cards, car loans, store cards—it’s easy to feel like you’re drowning in payments but getting nowhere.

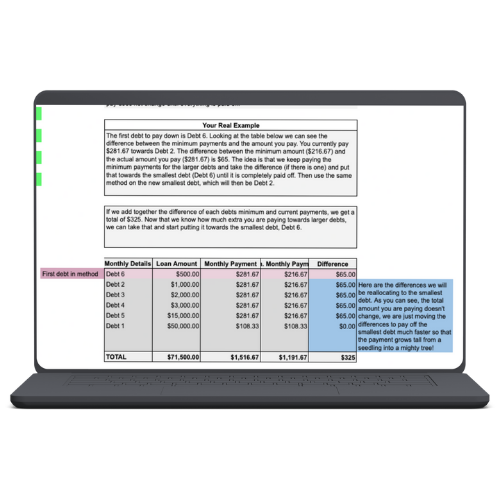

This template brings everything into one clear view. It does the math for you, showing you exactly how much to pay on each debt to clear them as fast as possible using the “Snowball Method.”

Why the “Snowball Method” Works: Math says you should pay the highest interest rate first. Psychology says you should pay the smallest balance first.

- Quick Wins: By knocking out the smallest debt quickly, you get a psychological “win” that motivates you to keep going.

- Momentum: The money you were paying on the small debt rolls over to the next one (like a snowball), growing larger and larger until your debts are gone.

How to use this tool:

- Download: Click the button above to save the Google Sheet.

- List Your Debts: Enter every single debt, the total balance, and the minimum monthly payment.

- Set Your Budget: Enter how much extra money you can throw at debt each month.

- Follow the Plan: The sheet will tell you exactly where to send your money this month for maximum impact.

FAQs

- Q: Is this the same as the Dave Ramsey method? A: Yes. The Seedling Method is built on the principles of the “Debt Snowball,” popularized by Dave Ramsey. It focuses on behavioral momentum rather than just pure interest rate mathematics.

- Q: Can I use this for business debt? A: While the math works the same, this tool is designed for personal finance (credit cards, personal loans, overdrafts). For complex business restructuring, you should speak to a financial advisor.

- Q: What if I want to pay the highest interest rate first? A: That is called the “Debt Avalanche” method. You can still use this spreadsheet to list your debts, but you would manually choose to attack the highest interest rate item first instead of the smallest balance.

Need to tackle business debt instead? If your business finances are the ones keeping you up at night, a personal finance spreadsheet won’t solve the root cause.

Let’s have a chat about restructuring your business for profit and resilience.