Free Cash Flow Forecasting Template for NZ Businesses

Stop Looking Backwards. Start Predicting Your Future.

Most business owners only look at their bank balance to see how they did last month. But sustainable growth requires looking forward.

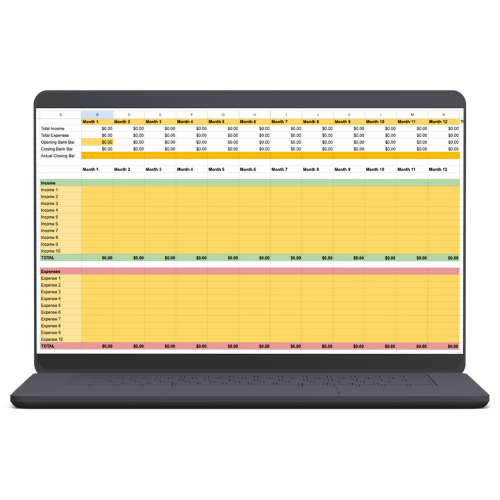

I created this simple, powerful Google Sheets template to help you answer the most important question in business: “Will I have enough cash in the bank 90 days from now?”

Why Profit is Vanity, but Cash is Sanity You can be “profitable” on paper and still run out of money. It happens to excellent NZ businesses every day.

This template isn’t about accounting compliance; it’s about operational survival and strategy. It allows you to map out your expected income against your committed expenses, giving you a clear visual roadmap of your financial future.

What this template helps you see:

- The “Crunch Points”: Spot the exact week you might dip into overdraft three months before it happens

- Investment Capability: Know with confidence if you can afford that new hire or equipment purchase in Q3.

- Peace of Mind: Stop waking up at 3 AM wondering if you can make payroll next week.

How to use this Cash Flow Tool

This tool is designed for simplicity. You don’t need to be an Excel wizard or a chartered accountant to use it.

- Download: Click the button above and select “Make a Copy” to save it to your own Google Drive.

- Input: Enter your starting bank balance.

- Forecast: Fill in your expected income (invoices sent or expected sales) and your committed expenses (rent, wages, software, tax).

- Review: The sheet automatically calculates your closing balance for each week/month.

FAQs

- Q: Why use a spreadsheet instead of Xero or MYOB? A: Accounting software is brilliant for historical records—telling you what has happened. A spreadsheet is often better for forecasting because it is flexible. It allows you to model “what if” scenarios (like hiring staff or losing a client) without messing up your actual accounting data.

- Q: How often should I update my cash flow forecast? A: At Nurture, I recommend updating your forecast weekly. Make it a Monday morning ritual. Reconcile what actually happened against what you predicted, and adjust the future weeks accordingly.

- Q: Is this template suitable for all NZ businesses? A: Yes. Whether you are a freelancer, a startup, or an established SME, the principles of cash flow are the same. This template is designed to be adaptable to service-based or product-based businesses.

Templates are great, but they don’t give advice.

A static spreadsheet is a good start, but it can’t tell you when to hire, how to price, or where you’re bleeding profit.

Don’t just fill in the boxes. Turn this forecast into a growth engine with a partner who knows how to read the story behind the numbers.