Free Business Loan Repayment Calculator

Know Your True Cost of Capital.

Before you sign on the dotted line for equipment finance, a vehicle loan, or a business overdraft, you need to know exactly what it will cost your cash flow every week.

I created this calculator to help you see beyond the “interest rate” and understand the real repayment numbers.

Interest Rates Are Only Half the Story A “low” interest rate can still cripple your weekly cash flow if the term is too short. Conversely, a long term might lower your weekly payments but double the total interest you pay.

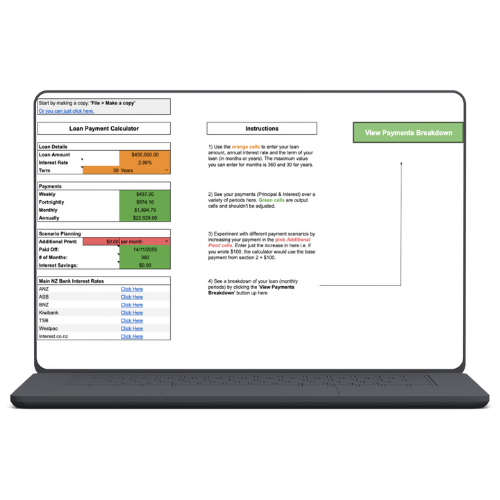

Use this tool to calculate:

- Weekly/Fortnightly/Monthly Repayments: See exactly how much cash will leave your bank account each pay cycle.

- Total Interest Payable: See the “real” cost of the asset over the life of the loan.

- Term Impact: Instantly see what happens if you switch from a 3-year term to a 5-year term.

How to use it:

- Download: Click the button above to save the Google Sheet.

- Enter Loan Amount: The total amount you are borrowing.

- Enter Interest Rate: The annual rate provided by the lender (e.g., 7.5%).

- Enter Term: How many years the loan will run.

- Review: The calculator instantly breaks down your repayment options.

FAQs

- Q: Can I use this for a mortgage? A: Yes, the math is the same for any “principal and interest” loan. However, this tool is designed with business finance in mind (typically shorter terms of 1-7 years).

- Q: Does this calculate “Interest Only” loans? A: No, this calculator assumes a standard “Principal + Interest” repayment structure, where you are paying off the debt and the interest simultaneously.

- Q: Why do my bank’s figures look slightly different? A: This calculator gives you the pure repayment figure based on the interest rate, which is usually accurate within a few dollars.

Need more than just a calculator? Getting the math right is step one. Getting the strategy right is step two.

If you need help understanding how your loan structure affects your cash flow, let’s have a chat. As a Virtual CFO, I help business owners navigate the numbers with confidence.